Ca 2024 Tax Brackets Single

- admin

- 0

- on

ca 2024 tax brackets single – What taxes will you owe on your capital gains? With a big year in the stock market in 2023 you could be facing a large tax bill. . It’s a new year, which means that the 2023 tax year is officially over and Canadians can begin filing their tax returns. In his financial advice column for CTVNews.ca, Christopher Liew shares some of .

ca 2024 tax brackets single

Source : www.forbes.com

IRS: Here are the new income tax brackets for 2024

Source : www.cnbc.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

IRS: Here are the new income tax brackets for 2024

Source : www.cnbc.com

Tax Foundation on X: “The IRS released its inflation adjusted tax

Source : twitter.com

Tax brackets 2024| Planning for tax cuts | Fidelity

Source : www.fidelity.com

IRS announced new tax brackets for 2024—here’s what to know

Source : www.cnbc.com

2023 2024 Tax Brackets & Federal Income Tax Rates – Forbes Advisor

Source : www.forbes.com

IRS announced new tax brackets for 2024—here’s what to know

Source : www.cnbc.com

California Income Tax 2023 2024: Rates, Who Pays NerdWallet

Source : www.nerdwallet.com

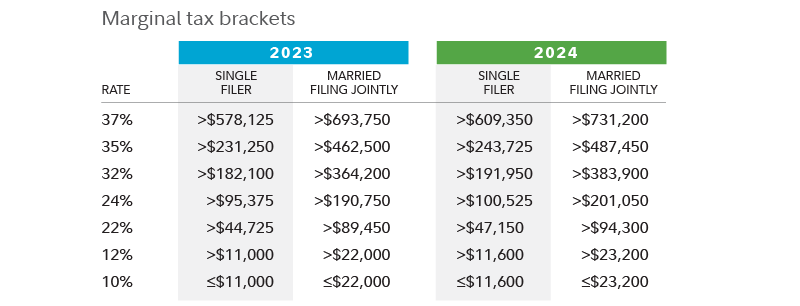

ca 2024 tax brackets single Your First Look At 2024 Tax Rates: Projected Brackets, Standard : There are seven federal income tax rates for 2023 and 2024: 10%, 12%, 22%, 24%, 32%, 35% and 37%, depending on your taxable income and filing status. . You can collect dividends from Brookfield Asset Management (TSX:BAM) in a TFSA and split the income with your spouse. .